top of page

Latest from Our Blog

All Blogs

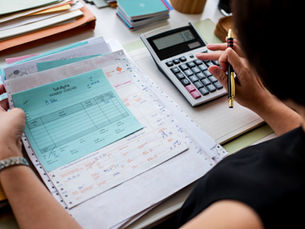

ATO Late Lodgment Penalty: What It Is and How to Avoid the Fine Before October 31

ATO late lodgement penalty 2025: The ATO’s clock starts ticking after October 31 — and each 28 days could cost you $330. Learn how these penalties work and how to avoid them by lodging safely with Precent before the deadline.

Aditi Bohara

Oct 131 min read

Donations & Gifts - When They’re Deductible (and When Not)

Not all donations and gifts are tax-deductible. Learn the ATO’s rules on what qualifies, what doesn’t, and how to avoid common mistakes when claiming deductions.

Aditi Bohara

Sep 182 min read

How to Lodge Your Tax Using an Online Tax Calculator – A Simple 2025 Guide

Struggling with tax time? You’re not alone. Whether you're an international student, part-time worker, or full-time employee in...

Sadiksha Subedi

Jul 282 min read

What Can I Claim on My Tax Return: Guide to Missed Deductions

Getting the most from your tax return isn’t about trickery’s about understanding your entitlements. And as the tax return deadline draws closer, it’s time to double-check the little things that could add up to a bigger refund.

Sadiksha Subedi

Jul 185 min read

Tax Return Deadline Extensions: What You Need to Know for 2025

Missed the ATO’s October 31 tax deadline? You might still have time. This guide explains who qualifies for a tax return extension in 2025, how to apply, and what role tax agents play.

Sadiksha Subedi

Jul 164 min read

Changing Careers: Are Education Expenses Tax-Deductible?

Explaining what study expenses can be claimed when switching careers.

Aditi Bohara

Jul 33 min read

bottom of page